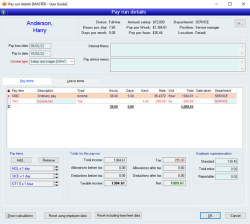

Pay run details

The Pay run details form manages the pay run details for a specific employee. The form is activated by selecting an employee in the pay run list and either clicking on the details button on the pay run form or by double-clicking on the pay run employee list entry.

Module: Payroll

Category: Pay run details

Activation: Main > Payroll > Pay run > double click Employee

Form style: Single instance

Special actions available for users with Administrator permissions:

- None

Database rules:

- None

Reference: button

This displays a read-only Employee form so that you can view details about the current employee.

Reference: date, QuickList, mandatory

This is the date from which the employee is being paid for the current pay run. This date is automatically defaulted to the date immediately after the last date to which the employee was paid or, if no such date exists, the Start date of the employee.

The pay from date can be modified as required, but must represent a valid date that is prior to the Pay to date.

Reference: date, QuickList, mandatory

This is the date to which the employee is being paid (inclusive). This date must represent a valid date that is after the Pay from date. The date to which an employee is being paid determines the default amount of pay that is allocated for an employee (this can be manually changed).

The next pay run in which an employee is included will have a Pay from date set to the day immediately after this date.

Reference: List

Employees now have an Income type selection that defines what kind of income they are earning. This field will default to the income type listed in the employees form but can be modified as required. This allows for multiple income types for employees.

If multiple income types are required for any employee, you will need to create a separate pay run for each income type.

Reference: text

A 2-character Country code must be reported when using the following income types

• Foreign employment income (FEI)

• Inbound assignees to Australia (IAA)

• Working holiday makers (WHM)

If you make payments to

• An Australian resident working overseas – Use the host country code

• A working holiday maker – Use their home country code

• Inbound assignees – Use the home country code of the foreign entity

A list of countries and their 2-character codes can be seen What are the 2-character Country codes available for Working Holiday Makers (WHM), Inbound Assignees to Australia (IAA), and Foreign Employment Income (FEI) income types?.

Reference: memo, expandable

This is an internal memo that can be entered specific to the current employee and is used for reference purposes only. This field would typically contain information explaining the reasons why an employee’s pay or leave is non-standard, if applicable.

Reference: memo, expandable

This is a memo that will be included on the employee’s pay advice. This would typically contain information regarding any pay or leave item irregularities for the pay run.

Reference: button

This is a special function that will show you very detailed workings of how all of the values on the pay run have been calculated. Clicking this button will also re-calculate the tax and other values on the pay run. Many of the steps and calculations in this screen will not be familiar to the average user, however you may be able to use this to interpret the underlying calculations and diagnose issues.

Reference: button

Clicking this button will cause values for this employee to be recalculated, based on the Pay from and Pay to date. Any pay items specified in timesheets entries will NOT be included in the pay run, regardless of whether the Allow auto transfer from timesheet option is set in the employee record.

Reference: button

Clicking this button will cause values for this employee to be recalculated, based on the Pay from and Pay to date. It will also cause any pay items specified in timesheets entries to be included in the pay run, regardless of whether the Allow auto transfer from timesheet option is set in the employee record.

Reference: list

This lists all the Pay items that have been included for the current employee and pay run. The list can include as many pay items as you like.

When an employee is initially added to a pay run, the Pay item list for the pay run for that employee is filled with all the employee’s Pay items that have been flagged to be included in a pay run. However, any Pay item that has been added by default in this way can be removed manually.

The details of the list are as follows:

- Pay item (text, read-only):

- Description (text): The description of the Pay item. This description can be modified for each pay item added to a pay run.

- Type (text, read-only): The type of Pay item (see Pay item type for more details)

- Hours / Days / Each (quantity): This is the quantity of units specified for the selected Pay item. The quantity specified can be any number, including a negative or zero. This field can only be modified if all of the following conditions are true:

- The current pay run to which the pay run details relate is in Edit or Add mode

- The selected pay item has its "Allow user to change quantity field" checked

- If the normal unit type for the pay item is days or hours, both Qty (days) and Qty (hours) quantity fields will exist in which you can enter a value. When you change a value in one of these fields, the corresponding value in the other field will change appropriately

- Rate (currency): This is the dollar rate of each unit for the selected Pay item. The unit to which the rate refers is the usual unit for the Pay item and is shown in the list to the left of the field. This field can only be modified if all of the following conditions are true:

- The current pay run to which the pay run details relate is in Edit or Add mode

- The selected Pay item has its Allow user to change quantity field checked

- Unit (text, read-only): The type of unit being used for the Pay item

- Total (currency, read-only): The total dollar amount of the Pay item line. This is equal to Qty * Rate

- Date Taken (date): This is the date on which the selected pay item was taken. If more than one day was taken, then this date should represent the first day of the taken period. This field is only available for pay items that are linked to a leave item included in the pay run

- Department (text, AutoComplete, QuickList): This is the Department to which the selected pay item is attributed. The department to which the selected pay item is attributed determines which Accounts are updated for salary expenses during the pay run. By default, the department is set to the department for the employee

Add pay item

Reference: button

This button displays the Pay item QuickList from which you can select one or more Pay items to add to the list of Pay items for the current employee.

You can add as many Pay items as you like for an employee, including duplicate Pay items. You cannot add internal Pay items. If you add a Pay item that requires other internal Pay items to be added as well (such as Tax or Leave Loading), they will be added automatically.

Adding or removing Pay items may cause all of the pay run’s Leave items to be re-calculated for the employee based on the new Pay item list.

After selecting this button, the employee code can be used as a search parameter. This means the search can be altered to automatically filter to pay items specific to that employee when the search is opened.

Last edit 10/12/19

Remove pay item

Reference: button

This button removes the currently-selected Pay item from the Pay item list. You cannot remove internal Pay items.

Quick pay items

Reference: button

These buttons allow you to quickly add or remove a single unit of the specified Pay item by clicking on the up or down arrows. Up to three QuickPay Pay items can be specified in the Employee information for the employee which will then appear on the Pay run details form for that employee.

Taxable income

Reference: currency, read-only

This label displays the amount of all taxable Pay items in the Pay items list. A taxable Pay item is a Pay item that has a Pay item type of Allowances before tax, Deductions before tax, Leave loading, Income or Special Income.

Taxable income is calculated based on the formula Taxable income = Total Income + Allowances before tax - Deductions before tax

Standard

Reference: currency

This is the total amount of employer-sponsored superannuation that has been calculated on the total of all Pay items having a Pay item type of Income.

The superannuation amount is separated into two separate amounts. The STD amount represents the total calculated from the standard superannuation rate calculations. The Extra amount represents the total calculated from the Additional employer-sponsored superannuation amount field.

Total extra

Reference: currency

This is the total amount of additional EMPLOYER-contributed superannuation for the pay run. The value that you see here will be automatically filled in as the pro rata amount of the value in from the employee’s file for “Additional employer superannuation for this financial year ($) ” if this has been specified. You can override whatever value is automatically put in here though, and enter you own value.

The value entered here will be used to create a superannuation expense and liability when the pay run is applied.

Reportable

Reference: currency

This is the total reportable value of additional EMPLOYER-contributed superannuation for the pay run. The value that you see here will be automatically filled in as the pro rata amount of the value in from the employee’s file for “…of which ($) X is reportable ” if this has been specified. You can override whatever value is automatically put in here though, and enter you own value.

The value entered here is NOT used in any financial transactions: it is only the reportable amount sent to the Tax Office with STP. For example, if the employer contributed $5,000 and all of it was reportable, then you would enter $5,000 in both the ‘Total extra’ box and the ‘Reportable’ box.

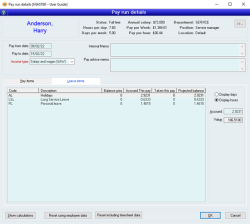

This lists all the Leave items that have been included for the current employee and pay run. The list will be the same as the leave items that are specified in the employee’s Leave item list, but only those Items that have been flagged as requiring accrual (the check box is set in the employee’s Leave item list) will have a default accrual value in them.

The details of the list are as follows:

- Code

- The Leave item code

- Description

- The description of the Leave item

- Balance Prior

- The employee’s current balance for the Leave item

- Accrued This Pay

- The number of hours or days of the Leave item that have accrued for the current pay run

- Taken This Pay

- The number of hours or days of the Leave item that have been taken for the current pay run

- Projected balance

- The projected balance of the Leave item for the employee once the pay run is applied

The units to which the balances refer are determined by the setting of the Display hours or Display days option buttons.

Reference: Yes/no

This displays all leave amounts in the Leave items list in terms of days.

Reference: Yes/no

This displays all leave amounts in the Leave items list in terms of hours.

Reference: number

This is the amount of hours or days (depending on the setting of the Display hours or Display days option buttons) of the selected Leave item that will accrue when the pay run is applied.

This amount is initially filled with the amount that has been calculated by the payroll system based on the quantity and type of Pay items that have been included in the pay run for the employee. For example, some Leave items may only accrue for certain Pay items and the amount that accrues is dependent on the Leave item settings and the quantity of hours / days specified for the relevant Pay items.

This field can only be changed if the pay run is in Edit or Add mode, and it will be recalculated whenever Pay items are added or removed for the employee, or the employee’s Pay to date is changed. For this reason, all Pay item and date adjustments should be done before any Leave item adjustments.

Reference: currency, read-only

This is the dollar value that will be accrued by the payroll system for the selected Leave item entry.

This amount is calculated as part of the dynamic leave liability feature of the payroll system. The amount is calculated so that when the pay run is applied, the total value of leave liability for the selected Leave item for this employee is exactly equal to the number of hours of that leave current in balance for the employee multiplied by the employee’s normal hourly rate. The effect of the calculation results in exactly the correct leave liability for each employee after every pay run.

Unless the employee has had a pay rise since the last pay run, this amount should equal the quantity of leave accrued multiplied by the employee’s hourly rate.

Each pay, Accentis Enterprise will auto-adjust the accrued leave. This will ensure that the provision at the end of the pay run is equivalent to the employee's hours * pay rate. This field can display both positive and negative values. A negative value in this field indicates the overall provision value needs to decrease. This could be caused by a change in pay rate or a change in a leave loading flag.

Last edit 25/06/22